Insurance can be REALLY confusing. If you or your spouse are lucky enough to be employed and that employer offers health insurance it’s a little bit simpler, but if that’s not the case you might need some help with your options. For the vast majority of people in that situation, they’ll end up on Medicaid, Medicare, or buying a commercial policy in a government “marketplace.” It helps if you know which of those options might apply to you. Here’s the quick-and-dirty version . . . ..

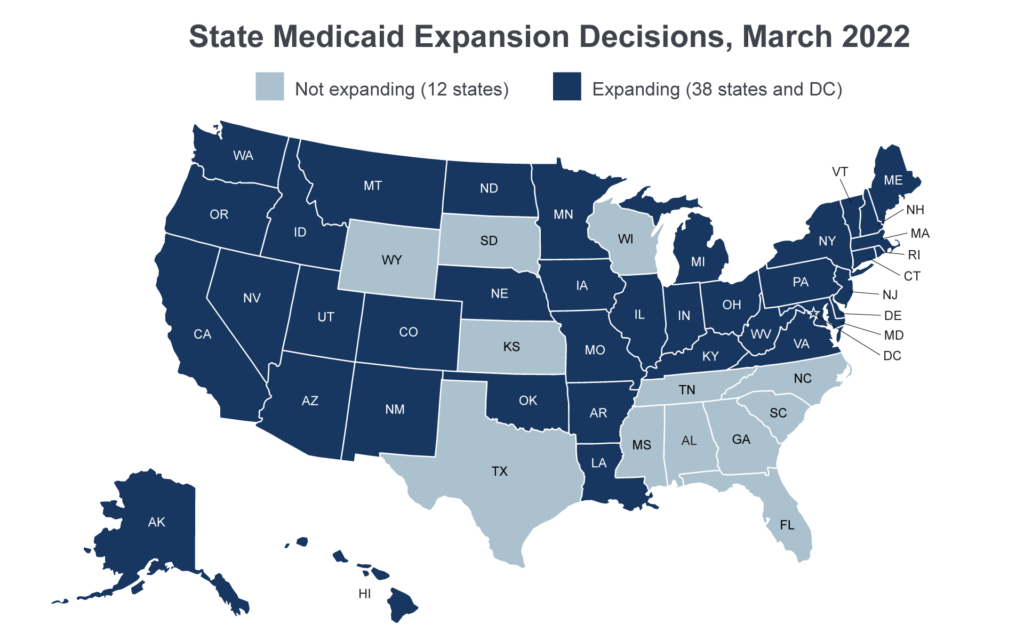

Medicaid – insurance for people below or near poverty line income. It provides medical care for free or for very low cost. It is a federal program but is run by the states and partially paid for by the states. As a result who is eligible, what is covered, and how it is administered varies SIGNIFICANTLY from state to state. The names of the Medicaid programs also vary by state: ex: Husky in Connecticut, Medi-Cal in California. It IS available in every state, but each state can set their own maximum income limits (Texas is the lowest and Washington DC is the highest) and there are a dozen states that have not “expanded” Medicaid to cover more people, so someone who qualifies for Medicaid in one state (most often childless adults) may not qualify in another state even if their income is zero.

The best place to get accurate information is https://www.benefits.gov/categories/Healthcare%20and%20Medical%20Assistance — go to this page and pick your state and “Medicaid and Medicare” from the drop down fields at the top

Medicare – Medicare eligibility is NOT based on your income (although high income people may pay a bit more for it). Medicare is generally available to people over 65 or older and also to people younger than 65 who are getting Social Security Disability Insurance payments two years after they become eligible for such disability payments. Note: even if you opt to get your social security retirement payments before you are 65 you still will not qualify for Medicare until you are 65. Railroad employees are similarly covered. Because they sound the same Medicare and Medicaid are often confused but they are VERY different. Medicare coverage involves premiums, only pays about 80% of most covered services (leaving you to pay the other 20%), and it doesn’t cover all things that are commonly covered by Medicaid programs. You can add on commercial insurance on top of medicare (supplemental policies, Medicare Advantage policies, Part D drug policies) that will help to cover some of the expenses that Medicare doesn’t cover and possibly to cover the Medicare deductible. The very best place to get accurate information about Medicare and add-ons is https://medicare.gov. Also see https://www.medicare.gov/your-medicare-costs/get-help-paying-costs if you have low income.

Medicaid AND Medicare – people who qualify for Medicare and are also very low income can have both of these types of insurance at the same time. Also very low income people who are receiving Social Security Disability Insurance payments (or similar railroad disability) who are waiting to become Medicare eligible can get Medicaid right away if they meet their state’s qualifications. https://www.benefits.gov/categories/Healthcare%20and%20Medical%20Assistance — go to this page and pick your state and “Medicaid and Medicare” from the drop down fields at the top

ACA aka Affordable Care Act aka Obamacare – These are commercial policies that meet the legal definition of health insurance and are SUBSIDIZED for people with moderate income (from 100% of the federal poverty level to 400% on a sliding scale). Some people qualify for subsidies which lower their premium all the way to zero. The same marketplace policies are also available to people with incomes above 400% of the FPL. For more information on the marketplace see https://www.healthcare.gov/apply-and-enroll/how-to-apply/

MIND THE MEDICAID / ACA GAP! People with incomes lower than 100% of the federal poverty level who live in states that have not expanded medicaid (see map below) can fall into a subsidy gap. They may not qualify for Medicaid in their state but they also will receive NO subsidy on ACA policies and thus will not be able to afford them.

Recent Comments